In the dynamic world of trading, understanding price action is a key component for successful decision-making. While various trading strategies exist, the focus here is on “free price action PDFs” as valuable resources for traders looking to enhance their skills.

What is Price Action?

Price action in trading refers to the study of price movements on a chart without relying on indicators. Traders using this strategy analyze historical price data to make predictions about future movements. Unlike other methods, price action is based on the belief that all market information is reflected in the price, making it a more transparent approach.

Advantages of Price Action Trading

One of the primary advantages of price action trading is its transparency. Traders can make decisions based on what the market is currently doing rather than relying on lagging indicators. This adaptability is crucial for navigating various market conditions effectively.

Candlestick Patterns

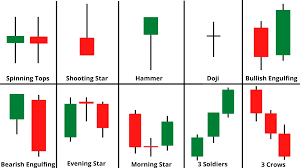

Understanding candlestick patterns is fundamental to price action analysis. Patterns like doji, engulfing, and hammer provide insights into market sentiment. Traders can use these patterns to anticipate potential reversals or continuations in price movements.

Support and Resistance Levels

Identifying support and resistance levels is another vital aspect of price action. These levels represent historical points where the price has struggled to move beyond or has found support. Recognizing these levels can aid traders in making informed decisions.

Trend Analysis

Price action traders also focus on analyzing trends. Recognizing whether the market is in an uptrend, downtrend, or ranging can guide trading strategies. Trends provide valuable information for making entry and exit decisions.

Risk Management in Price Action Trading

While mastering price action is essential, managing risk is equally crucial. Price action traders employ techniques like setting stop-loss and take-profit levels and calculating position sizes to protect their capital.

Psychology of Price Action

Understanding the psychological aspects of trading is integral to price action success. Emotional biases can impact decision-making. Price action traders learn to control emotions, enhancing their ability to execute strategies effectively.

Building a Price Action Trading Strategy

Creating a personalized price action strategy involves combining different elements learned. Traders should test and refine their strategies over time, adapting to changing market conditions.

Common Mistakes in Price Action Trading

Avoiding common pitfalls is crucial for long-term success. Learning from mistakes is an ongoing process that helps traders continually improve their skills.

Resources for Learning Price Action

Various resources, including books, courses, and websites, provide in-depth knowledge of price action. Continuous learning is vital for staying updated in this ever-evolving field.

Real-life Examples

Examining real-life examples of successful price action trades offers valuable insights. Case studies demonstrate how traders applied price action principles to achieve positive outcomes.

Keeping Up with Market News

Staying informed about current events is essential for price action traders. Market news can influence price movements, requiring traders to adapt their strategies accordingly.

Benefits of Free Price Action PDFs

Free price action PDFs offer accessible educational resources. These guides can enhance learning by providing comprehensive information and practical insights into price action strategies.

Conclusion

In conclusion, mastering price action is a journey that requires continuous learning and practical application. Traders can benefit from free price action PDFs as valuable tools to enhance their understanding and improve their trading skills.

FAQs

- Are free price action PDFs suitable for beginners?

- Absolutely! Free price action PDFs often cater to beginners, providing a solid foundation for understanding price action.

- How often should I update my price action strategy?

- Regular updates are advisable, especially when market conditions change. Periodically reassess and refine your strategy for optimal results.

- Can I solely rely on price action for trading decisions?

- While price action is powerful, incorporating it with other forms of analysis can provide a more comprehensive trading strategy.

- Do emotional aspects really matter in price action trading?

- Yes, emotional control is crucial. Emotional biases can cloud judgment, leading to poor decision-making.

- Where can I find reliable free price action PDFs?

- There are various online platforms, forums, and educational websites offering free downloadable PDFs on price action.

Related articles

understanding price action pdf free download

free price action trading strategies pdf

price action patterns pdf free download