In the fast-paced world of trading, where every decision can make or break your success, having a robust entry and exit strategy is paramount. This article delves into the intricacies of price action entry and exit strategies and explores how traders can navigate the dynamic market landscape for optimal results.

Importance of Entry and Exit Strategies

Your success as a trader hinges on your ability to navigate the unpredictable waves of the market. An effective entry and exit strategy not only safeguards your capital but also opens doors to profitable opportunities. It’s the compass that guides you through the labyrinth of trading, ensuring you make informed decisions.

Understanding Price Action in Trading

At the heart of price action strategies lie candlestick patterns, support and resistance levels, and market trends. These elements form the basis of interpreting price movements without relying on indicators. Traders who grasp the language of price action gain a deeper understanding of market dynamics.

Key Components of an Effective Entry Strategy

A successful entry strategy involves a meticulous analysis of trends and recognition of price patterns. By identifying the prevailing trend and understanding patterns like pin bars or engulfing candles, traders can make well-informed decisions, setting the stage for profitable trades.

Common Mistakes to Avoid in Entry Strategies

One common pitfall is chasing the market, entering a trade impulsively without proper analysis. Ignoring trend confirmation is another blunder that can lead to losses. Patience and discipline are crucial in crafting a reliable entry strategy.

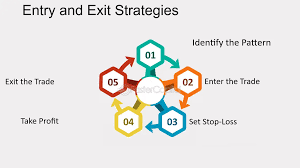

Crafting a Solid Exit Strategy

Knowing when to exit a trade is as crucial as entering one. Setting stop-loss and take-profit levels based on careful analysis prevents emotional decision-making and minimizes potential losses. Recognizing signs of trend reversal is equally essential for preserving gains.

The Psychological Aspect of Price Action Strategies

Trading is not just about numbers; it’s about mastering your emotions. Emotional discipline is the cornerstone of successful trading. Staying focused during market fluctuations and adhering to a well-defined strategy can shield you from impulsive decisions.

Real-Life Examples of Successful Price Action Entry and Exit Strategies

Let’s examine real-life case studies where traders effectively applied price action strategies. These examples illustrate the practical application of these strategies and highlight their impact on successful trades.

Adapting Strategies to Different Market Conditions

A robust strategy is versatile enough to thrive in both bullish and bearish markets. Understanding how to tailor your approach to different conditions ensures your strategies remain effective, regardless of market sentiment.

Continuous Learning and Improvement

The market is dynamic, and successful traders never stop learning. Staying updated on market trends, analyzing past trades for improvement, and adapting to evolving market conditions are essential for sustained success.

Tools and Resources for Price Action Traders

Equip yourself with the right tools and resources to enhance your price action trading. Choose reliable trading platforms and invest time in educational materials that deepen your understanding of price action strategies.

Combining Price Action with Other Technical Analysis

While price action is powerful on its own, combining it with other technical analysis tools can amplify its effectiveness. Understanding the synergies between different analysis methods empowers traders with a more comprehensive view of the market.

Keeping it Simple: The KISS Principle in Price Action Strategies

The “Keep It Simple, Stupid” (KISS) principle holds true in price action strategies. Complexity often leads to confusion. Embracing simplicity in your approach can be the key to clarity and success in the world of trading.

Pros and Cons of Price Action Strategies

Flexibility and adaptability are the strengths of price action strategies. However, they are not without limitations. Understanding the pros and cons allows traders to make informed decisions and manage expectations realistically.

Conclusion

Mastering price action entry and exit strategies is a journey of continuous learning and adaptation. By understanding the nuances of the market, staying disciplined, and embracing simplicity, traders can navigate the complexities of trading with confidence.

FAQs

- Q: Are price action strategies suitable for beginners?

- A: Yes, price action strategies can be beginner-friendly as they rely on understanding basic market movements and patterns.

- Q: How often should I review and update my entry and exit strategies?

- A: Regular reviews are essential, and updates should be made based on changes in market conditions or personal trading experiences.

- Q: Can price action be applied to cryptocurrency trading?

- A: Absolutely. Price action principles are universal and can be effectively applied to various markets, including cryptocurrencies.

- Q: Is it necessary to use complex indicators alongside price action?

- A: Not necessarily. Price action can be powerful on its own, but some traders may choose to combine it with other indicators for a more comprehensive analysis.

- Q: How do I control emotions during trading?

- A: Developing emotional discipline involves self-awareness, mindfulness, and sticking to a well-defined trading plan.

Related articles

understanding price action pdf free download

free price action trading strategies pdf

free price action pdf